Receipt For Donation

A donation tax receipt is essential for your organization and donors and they ensure youre maintaining good relationships with your donors. Plus theyre using their receipt to drive potential corporate matching gifts.

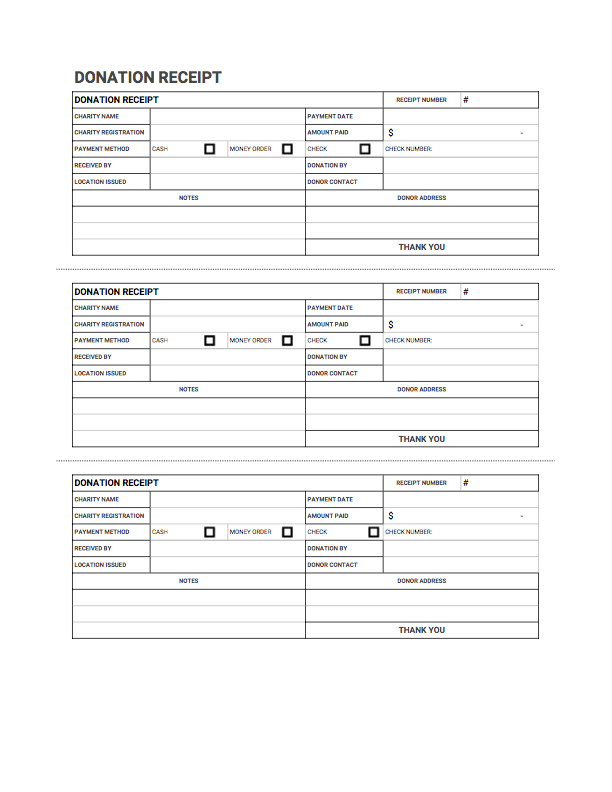

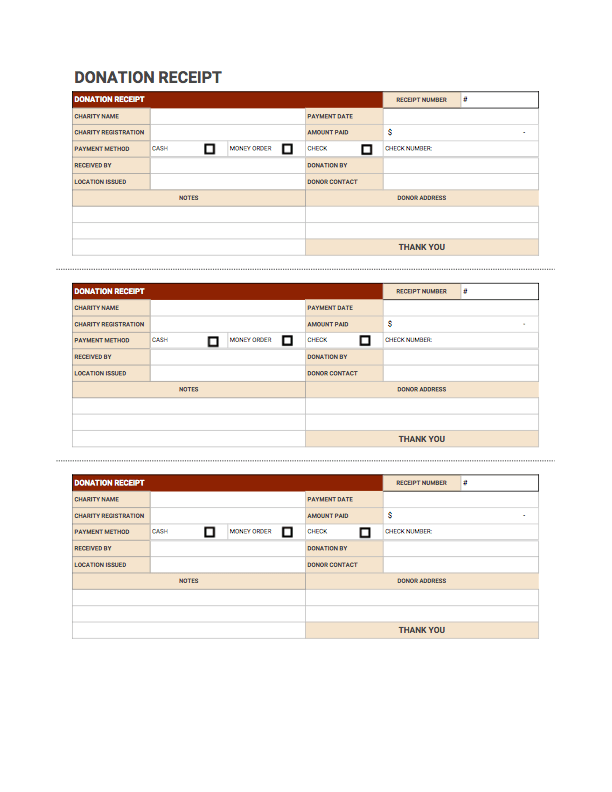

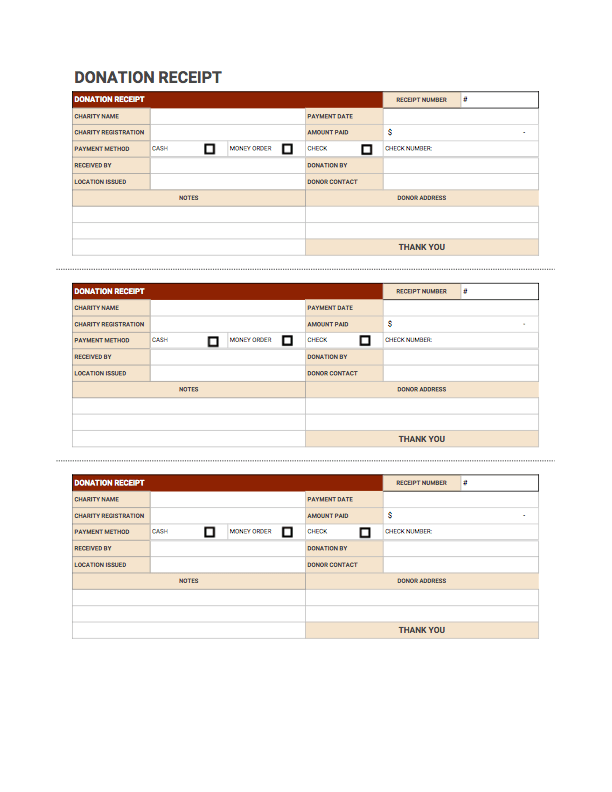

Donation Receipt Free Downloadable Templates Invoice Simple

This helps the donor to know hisher total tax deduction for the charity contribution.

. The 501 c 3 donation receipt is customarily sufficient proof of a donors eligibility to the IRS. Build Receipts Other Transaction Records Free - Easy-to-Use Platform. Standards may vary from where you live and what laws or rules apply there.

XXX The serial number of the receipt. Donations less than 250 do not need a 501 c 3 donation receipt to be deducted in tax filings. 501c3 Donation Receipt Template.

Goodwill SCWIs tax ID number is 39-114-7571. Ad Save time get organized and look professional with our fully customizable template. In the USA only 501 c 3 registered charity can be considered as tax-exempt such as private foundations and public charities.

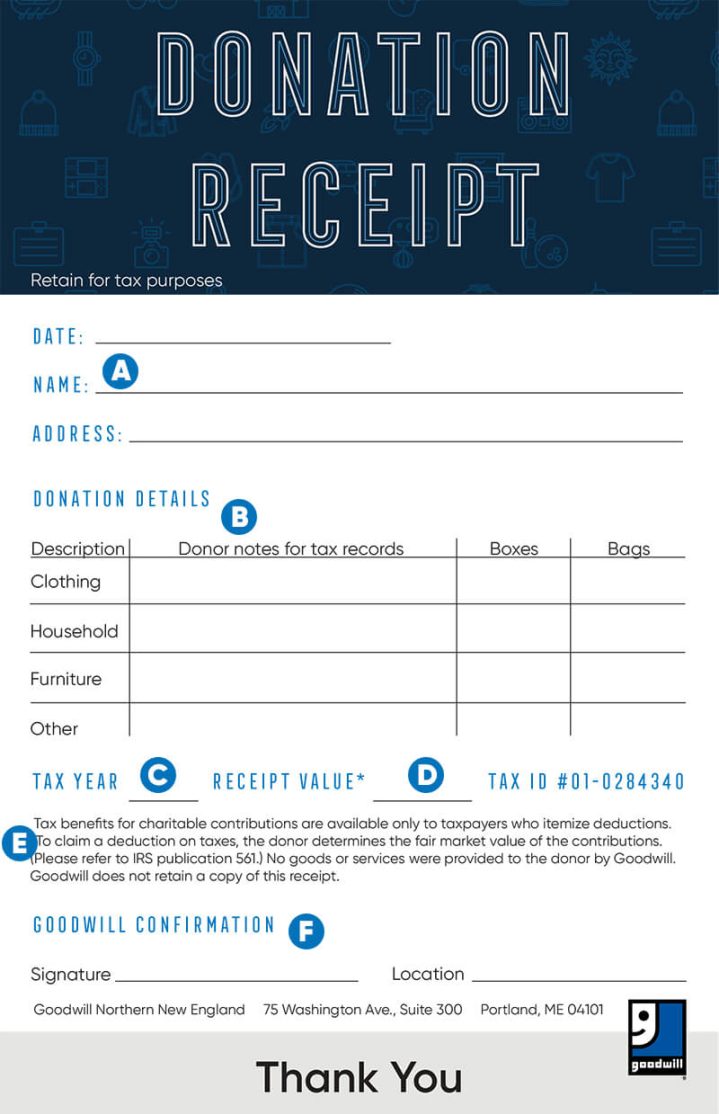

Give a donation receipt for a donation of at least 75 which is used to buy goods or services. Remember that different regulations and content apply to what should be present in a standard receipt for a donation. Please keep your receipt for tax purposes and note that Goodwill SCWI does not retain a copy.

That means that if the donor pays 75 and receives a calendar or a dinner for example you must provide a receipt under law. Please note that it is the responsibility of the donor to determine fair market value of the items donated. 3 best practices when writing donation receipts 1.

They are often letters or emails sent to a supporter after a donation has been made. However unreimbursed expenses such as transportation costs incurred by the donor on behalf of the charity are considered donations and donors. 501 c 3 charity donation receipt is written by the charity organization upon receiving contributions worth 250 and above.

A donation receipt is proof that a donor made a monetary or in-kind contribution to an organization. Remember to say thank you Donation receipt letters may have some formal requirements but theyre also an opportunity. The donor should receive a non-profit receipt with a written disclosure of the amount that exceeds the fair market amount of the goods or services given in return.

If you provide a good or service in return for a donation of 75 or more you are required to provide a receipt to the donor. A smart idea would be to check your local governments websites for a list of those rules. Avoid promising tax deductions A charitable donation receipt doesnt promise anything to a donor in terms of how.

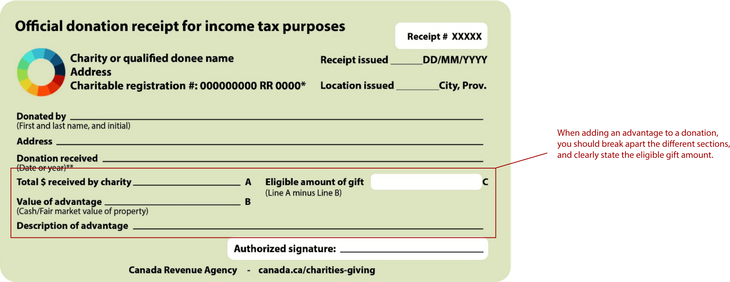

When a donor requests a donation receipt. Official donation receipt for income tax purposes A statement that identifies the form as an official donation receipt for income tax purposes. It acknowledges that a gift was made to you and that the receipt contains the information required under the Income Tax Regulations.

A donation receipt acts as a written record that a donor is given proving that a gift has been made to a legal organization. While the content is simple the timing and manner in which you deliver them might make the difference between happy donors and tax season difficulties. Give a receipt for a donation of 75 that buys goods or services.

This could be due to hisher companys reasons or. Our site shows when receipts are sent viewed by your customer and accepted or declined. Thank you for your donation.

Many nonprofits send receipts out by the end of the year the gift was given or. No goods or services were exchanged for this donation. Mistakes to Avoid When Giving Donation Receipts.

This is required by law. Receipts for donations are an important element of the giving process and recognizing donors. 1 Legal Form library PDF editor e-sign platform form builder solution in a single app.

Campaigns receipt is designed to provide their donors with all the information they need to use their receipt for their tax purposes while making sure their donors feel appreciated and that their donation is making an impact. Ad Download Or Email ACS Forms More Fillable Forms Register and Subscribe Now. Ad Create Edit Sign Receipt Documents Online Today - Fast Easy Free.

Receipts should be streamlined in a method that is fully approved by the IRS. We recommend that you use a donor management system that has an automatic receipt feature built in. Always give a donation receipt if the donor or beneficiary asks for it no matter what amount was given to the organization.

These receipts are also used for tax purposes by the organization. The receipt is important to the donor who gives out cash vehicle or personal property and wishes to have a tax deduction on the donation.

Nonprofit Donation Receipt Letter Template

Donation Receipts Statements A Nonprofit Guide Including Templates

Donation Receipt Template Download Printable Pdf Templateroller

Nonprofit Donation Receipts Everything You Need To Know

Free Goodwill Donation Receipt Template Pdf Eforms

Donation Receipt Free Downloadable Templates Invoice Simple

How To Fill Out A Goodwill Donation Tax Receipt Goodwill Nne

Comments

Post a Comment